During Budget 2016, Government announced a new measure to encourage further partnerships between Malta’s business community and the cultural sector.

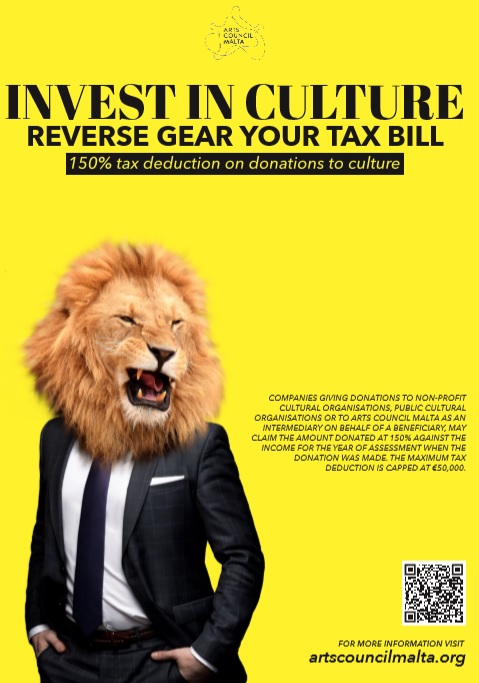

Through this measure, companies giving donations to eligible organisations, may claim the amount donated at 150% against the income for the year of assessment when the donation was made. The maximum tax deduction is capped at €50,000. This incentive came into effect as of 1st January 2016.

Who can apply as a donor?

This incentive is intended for Limited Liability Companies and those Partnerships that are registered to be treated as a company.

Who can be the beneficiary of an eligible donation?

The main beneficiaries are intended to be not-for-profit Cultural Organisations, Public Cultural Organisations, Arts Council Malta and other organisations as may be listed in the incentive guidelines.

What is a not-for-profit cultural organisation?

A not-for-profit cultural organisation is a registered Voluntary Organisation [VO] or Non-Governmental Organisation [NGO] that uses its surplus revenues to further achieve its purpose or mission, rather than distributing its surplus income to the organisation's shareholders (or equivalents) as profit or dividends.

For the purpose of this tax deduction, beneficiaries listed as a not-for-profit cultural organisation must also be registered with the Commissioner Voluntary Organisations. They must be active and operating in the cultural sector with activities in any of the categories listed in the Arts Council Malta Act.

What qualifies as a donation to Arts Council Malta?

Donations to the Arts Council Malta shall include monetary donations given directly:

Downloadable documents:

CVO Approved Cultural, Arts and Heritage

Subsidiary Legislation 123.102

L.N. 147 of 2016 - Amendment to Subsidiary Legislation 123.102

Submitting ...

Saving ...

Any applications related to this entity, will also be automatically deleted.